Making Your Pre-Tax Dollars Go Further

Hi! Who is excited for summer? I am. I really really am! I can’t wait to wear shorts, tank tops, dresses, rompers, bathing suits, and flip flops! This pale body really needs some sunshine, warmth, and beaches. As a Michigander, we have had quite a few overcast days this Spring… am I the only one who seems to get sunburnt on those overcast days when it is warm enough to wear a tank top and shorts but not warm enough where you feel like you need sunscreen? I call this the pre-summer tanning base. Which… makes me add to my ongoing mental to-do-list, “purchase sunscreen.” Then my mind keeps going (of course) adding to the mental to-do-list of other items my family needs for the summer.

Before going on Amazon to purchase sunscreen, aloe vera, bug spray, chapstick, and other summer supplies - let’s take a moment to talk about how to pay for these items. It may not be what you think!

Through your health insurance, if you have a high deductible health plan (HDHP) that includes a health savings account (HSA), you can potentially use those pre-tax dollars to pay for your summer items, saving you your hard earned money to spend or save elsewhere! This applies for flexible spending accounts (FSAs) too!

One of the best financial decisions our family has made is enrolling in a HDHP for our insurance coverage because we have the option of enrolling in a health savings account. We are also, typically, minimal healthcare consumers so the HDHP works for us. As defined by healthcare.gov, an HSA is “an account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses, as defined in the tax law.”

There are a lot of benefits with an HSA and I think HSA’s are an underutilized financial tool. I view an HSA as an additional savings account to support myself and my family now and in the future. Some of the benefits I love about using an HSA:

The obvious one, HSA funds can be used to pay for your medical bills - medical, dental, and vision bills including deductibles and copays.

An HSA never expires and rolls over year after year - if you move from your current employer to another employer or if you leave the workforce, the pre-tax money you set aside in an HSA is YOUR money. You can take it with you wherever you go!

An employer can contribute to your HSA - which adds to your financial savings goals and flexibility.

HSA’s function as a long-term savings account - you can keep adding to this account over your entire lifetime (as long as you have a HDHP) and withdraw from it for eligible expenses by using the HSA debit card. You can also make purchases on your credit cards to earn points or perks and then reimburse yourself from your own account. Make sure you hang on to the receipts!

For HSAs, when you are near retirement age, you can withdraw funds from your HSA without an extra penalty. If you withdraw money from your HSA for a non-qualified medical expense, then you pay income tax on it. You can truly treat an HSA as an additional retirement account!

HSA’s lower your taxable income - as you put money away in pre-tax dollars, that lowers your overall taxable income which can put more money in your pocket. Yes, please!

An HSA can be flipped into an investment account - once you hit a certain dollar amount in your HSA, you can consider investing those dollars to earn you additional income.

Probably the most underutilized portion of an HSA is using the funds to pay for additional health-related items - more on this below.

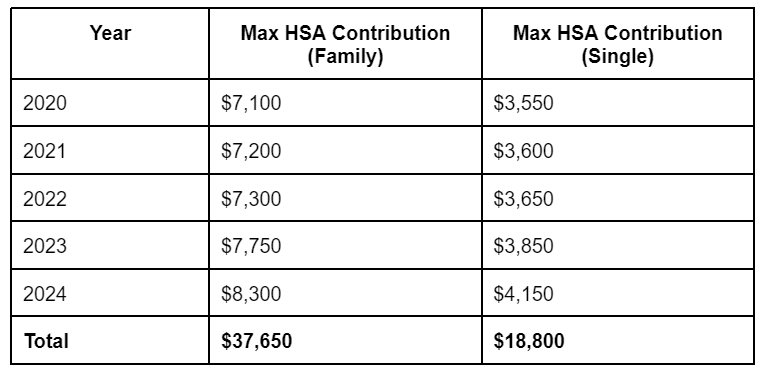

I would say, there a LOT of benefits. So how does this translate into real dollars and cents? In 2024, the HSA pre-tax contribution limits are $4,150 for individuals and $8,300 for families (as determined by the IRS). If you are able to put away the maximum amount, which is difficult to do, then you are able to lower your overall taxable income by quite a bit and start a fantastic nest egg! Let’s say you put the maximum dollar amount away for the past 5 years:

Wow, that is a good chunk of change to pull from when you need it or to let it accrue interest over time! Now this isn’t saying you are not going to spend some of the money you set aside in your HSA. One benefit of having an HSA is to help you with ongoing medical expenses. I know each individual or family has varying expenses per year for healthcare. It is really difficult to average out healthcare costs for an individual or a family. You probably have an idea of your healthcare spending so this could give you a good idea of what you may be able to save. Even if you are able to save a minimal amount year after year, that still adds up over time.

Something that helps stretch those pre-tax dollars is learning about “HSA-eligible qualified medical expenses.” Things like sunscreen and aloe vera are actually designated as an HSA-eligible qualified medical expense. You can either use your HSA debit card or your personal credit card to purchase these items and then reimburse yourself for the expense. You do not have to use your post-tax dollars purchasing these items!

If you Google HSA-eligible qualified medical expenses, then you will get a long list of items to review. Most of them will make sense and yet there are some unexpected items on the list that are nice surprises! Take a look at these unexpected items:

Allergy & Sinus Medication

Baby Breathing Monitors

Band-Aids

Blue Light Blocking Glasses

Breastmilk Storage Bags

Cough, Cold, & Flu Medications

Cough Drops

Diaper Rash Cream & Ointment

Electrolyte Replacements

Eye Drops

Face Cream with Medication

Feminine Hygiene Products

First Aid Kits

Fuel / Gasoline for Medical Care

Heating Pads

Hemorrhoid Treatment

Insect Repellant & Anti-Itch Cream

Lasik Eye Surgery

Lice Treatment

Lip Balm (SPF 15+)

Lip Treatments for Cold & Canker Sores

Medicated Shampoos & Soaps

Nasal Sprays & Aspirator

Nursing Bras

Pain Relievers

Parking Fees for Medical Care

Pregnancy Tests

Prenatal Vitamins

Prescription Sunglasses

Skin Creams, Cleansers, Moisturizers, Ointments, & Toners

Sleep Aids

Sunscreen & OTC Remedies to Treat Sun Exposure (like aloe vera)

As summer is approaching and your mental to-do-list grows, like mine does on an hourly basis, seriously consider stretching your dollars by using your HSA funds for HSA-eligible qualified medical expenses. They really do help stretch your budget for recurring, seasonal items. I hope this was helpful to you and please share with others! My next blog on budget friendly ideas will be shared on May 6th!

Reference Links:

The Motley Fool: https://www.fool.com/retirement/plans/hsa/eligible-expenses/

Health Equity: https://www.healthequity.com/hsa-qme